Contents

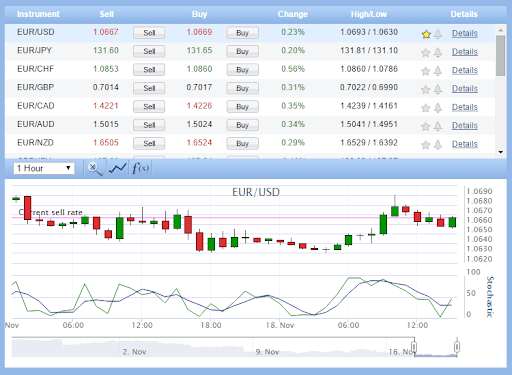

Trade online in up to 25+ different currencies with real-time quotes and direct execution of your transactions. She monitored the difference from the moving average as a function of time for 2, 5, and 10 days after the event. A forex derivative lets you bet on the changing hitbtc exchange review value of currencies without trading actual currency. The best time to buy stocks could be right after an IPO, during expansion periods or when other investors are buying or selling. You may find a good rate at one provider but later find an even better rate elsewhere.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website. Please note CMC Markets does not provide the ability to trade FX Options, this information is for educational purposes only. This promotional material is prepared by OCBC Wing Hang Bank Limited, and the contents have not been reviewed by any regulatory authority in Hong Kong. It is not principal protected, and you may lose the entire Principal Amount.

Not So Foreign: Unpacking the Currency Market and USX Options Strategies

Exchange rates impact agricultural commodity prices and farmers’ margins. Alternately, if a processor or producer needs to buy a product in the United States, the risk would be that they must pay a higher commodity price if the CAD falls. In this case, the processor or producer would take a short hedge CAD futures position. If the value of the CAD drops, the higher price in CAD paid for the product would be offset by a profit on the CAD futures position.

Find Bank of Canada publications by keyword, author, content type, JEL code, topic or publication date. See the short list of portrait candidates for the next $5 bank note. A well-diversified portfolio has exposure to many different currencies. The interplay between baskets of currencies is sometimes referred to as a natural hedge.

- The Request for Quote feature makes executing foreign exchange transactions online simple and convenient.

- All content is provided for informational purposes only , and is not intended to provide legal, accounting, tax, investment, financial or other advice and should not be relied upon for such advice.

- “Trend reversion occurred in 90 percent of the cases,” Keefe said.

- For example, let’s say you buy a binary option for $50 that says the euro/CAD dollar ratio will be more than $1.10/$1.00 on October 1, 2019 at midnight.

- To limit this risk, traders can use stop-loss orders on options, just like with spot trades.

- However, you will find options at forex trading platforms and some banks.

These protocols are continuously monitored and independently verified. Simultaneous purchase and sale of foreign currency for two different value dates. Friedberg Direct’s AvaOptions is not only a leading platform for trading options but also one that was built with the client in mind.

USX Options Strategies to Consider

If the CAD exchange rate rises and the price of the product remains constant in CAD, Canadian exports will appear more expensive to buyers. Exchange rate changes impact Canadian export prices, the price of imported inputs, and the competitiveness of the Canadian agriculture industry. The Canadian exchange rate versus the USD is arguably the most important as nearly 40% of Alberta’s total agri-food export sales were to the United States in recent years. If the investment involves Renminbi, you should note that the value of Renminbi against other currencies fluctuates and will be affected by, amongst other things, the PRC’s government control.

Options prices are derived from the base currency, which is the first currency in the currency pair (eg euros in EUR/USD). If you are bullish on the base currency then you should buy calls or sell puts, conversely if you are bearish you should coinbase exchange review buy puts or sell calls. The risk for an option buyer is limited to the cost of buying the option, called the ‘premium’. Conversely, for an option seller the risk is potentially unlimited, but the profit is fixed at the premium received.

In addition, since options are contracts to trade in the future, there is a time element. The date on which the option can be exercised is called the expiration date, and the price at which the option buyer can choose to execute is the strike price. Longer-dated options have higher premiums than shorter-dated options, much like buying insurance. Vanilla options are contracts giving traders the right to buy or sell a specified amount of an instrument at a certain price at a pre-defined time.

How foreign exchange options work

The mid-market rate is what your money’s actually worth on the global market compared to another currency. It’s the midpoint between worldwide supply and demand for that currency — and the rate banks and transfer services use when they trade among themselves. If you want to trade foreign exchange options, you’ll need to find a vintage fx reputable broker. While it is possible to trade options directly with a buyer or seller, known as OTC options, it’s generally much riskier than going through a reputable exchange. TMX Group Limited and its affiliates do not endorse or recommend any securities issued by any companies identified on, or linked through, this site.

If he turns out to be right and spot is lower than the strike price by at least the premium value, he will earn profits. Another key factor in determining the premium is the volatility of the underlying instrument. A trader can choose to close his option position on any trading day, profiting from a higher premium, whether it has risen due to increased volatility or the market moving his way. However, you will find options at forex trading platforms and some banks. In fact, you have just described the foreign exchange market and, in particular,… When a Canadian producer plans to sell a product at a price that is originally set in the United States market, the risk is that the cash price the producer receives in CAD will fall if the CAD rises.

A foreign exchange option — also known as a forex option, FX option or currency option — is a type of foreign exchange derivative that gives you the option to buy or sell currency at a specific price. FX options are also available through regulated exchanges which are options on FX futures, in which case it is simply a call or a put. These offer a multitude of expirations and quoting options with standardised maturities. When traded on an exchange, FX options are typically available in ten currency pairs, all involving the US dollar, and are cash settled in dollars.

Perhaps the most unique advantage of options is that one can express almost any market view, by combining long and short, call and put options, and long or short spot positions. He can buy a put option for his target expiration date, sit back and relax. Whether USDJPY goes up or down tomorrow, he is safe in his position all the way to the expiration date.

Mutual Funds

We may also receive compensation if you click on certain links posted on our site. While compensation arrangements may affect the order, position or placement of product information, it doesn’t influence our assessment of those products. Please don’t interpret the order in which products appear on our Site as any endorsement or recommendation from us. Finder.com compares a wide range of products, providers and services but we don’t provide information on all available products, providers or services. Please appreciate that there may be other options available to you than the products, providers or services covered by our service. Learn the basics about Forex – the foreign exchange market where international currencies are traded against each other for a profit or loss.

Trading procedures

In the long-term, exchange rate changes influence the investment and production of the agriculture sector. The agri-food industry needs to improve productivity and efficiency in order to remain competitive in the international market if the CAD remains high. As an example, a Canadian hog producer signs a contract to sell hogs in the United States in USD.

Compare forex trading platforms

Information obtained from third parties is believed to be reliable but RBC GAM and its affiliates assume no responsibility for any errors or omissions or for any loss or damage suffered. RBC GAM reserves the right at any time and without notice to change, amend or cease publication of the information. The risk of loss in online trading of stocks, options, futures, currencies, foreign equities, and fixed Income can be substantial. When buying an option – whether a put or a call – the trader pays the upfront premium from his account’s cash balance, and his potential earnings are limitless. When selling options, however, a trader receives the premium upfront into his cash balance, but is exposed to potentially unlimited losses if the market moves against the position, much like the losing side of a spot trade. You can use a foreign exchange option to protect yourself if exchange rates move against you.